December 8, 2016

Albert Edwards is worried, very worried.

This may not be atypical for Societe Generale’s perma-, über-bear, as he has been concerned about the state of the global economy for years, but apparently a new chart has him even more on edge than usual.

“I sometimes feel like ‘The Grim Reaper,’ scouring the research savanna in a ghoulish quest to harvest bad news with a forceful sweep of my scythe,” Edwards wrote in a note to clients on Thursday. “Imagine then my perverse delight when our credit team produced what is one of the scariest charts I have seen for a very long time.”

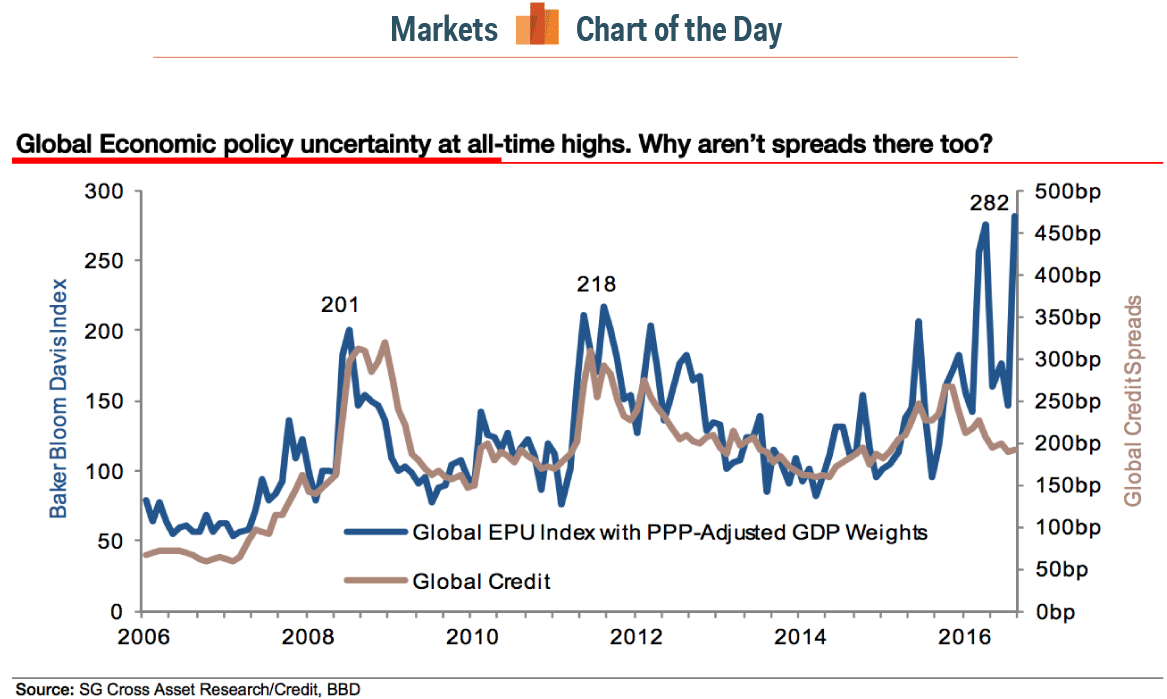

The chart in question, originally from SocGen’s credit-strategy team, showed that while economic-policy uncertainty had been skyrocketing after the UK’s Brexit vote and the US election of Donald Trump as president, the bond market hasn’t moved all that much.

Historically, according to Edwards, there has been a close relationship between the Economic Policy Uncertainty Index — which hit an all-time high after Sunday’s Italian referendum — and credit spreads (using a mix of US, UK, and euro corporate bonds against their benchmarks): In times of higher uncertainty, global credit spreads have gone up.

Edwards noted that that this relationship, however had been much weaker recently than in the past. Put simply, the debt market hasn’t seen a lot of selling or instability even though the outlook for global policy is murkier than it has been in over a decade.

Edwards included commentary from Guy Stear, SocGen’s head of emerging markets and credit research. From the note:

“In 2008 and 2011, the correlation between economic policy uncertainty and credit spreads was very close. As uncertainty rose, so did spreads, but something different is happening now. The EPU index is up at all-time highs, but spreads are at the median levels of the period going back to 2008. The chart implies that given the current level of economic policy uncertainty, global spreads should be twice as wide. This ought to worry the bulls.”

In Edwards’ opinion, the credit market is too Pollyannaish. There’s the possibility the European Union could break up after the Brexit vote and the Italian referendum, and the election of Trump as US president could bring about either a trade war or a corporate boon. Instead of discounting this risk, Edwards said, the market seems to be simply ignoring it. From Edwards’ commentary (emphasis ours):

“Markets shrugged off the Brexit vote in a couple of days. They shrugged off Donald Trump’s election in a single day. They shrugged off the Italian Referendum result in a couple of hours. Heck, in this mood they would shrug off an alien invasion of planet Earth. But global political risk is now at such elevated levels that investors must surely be on another planet.”

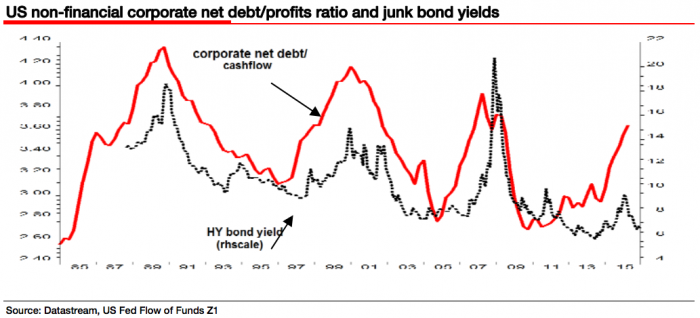

The strategist noted that he had long been worried about the sheer amount of corporate debt floating around. He said, in fact, that the relationship between junk-bond spreads and the amount of debt showed how the credit market had lost touch with reality.

“It is not just the levels of political uncertainty that suggest corporate yields should be considerably above current levels,” Edwards wrote. “Normally at this level of corporate debt accumulation, investors have begun throwing their toys out of the pram.”

Between the policy uncertainty and the massive level of high-risk debt, Edwards thinks the bond market should be selling off much more because of this, as Edwards concluded, “toxic Martian mix.”

Between the policy uncertainty and the massive level of high-risk debt, Edwards thinks the bond market should be selling off much more because of this, as Edwards concluded, “toxic Martian mix.”